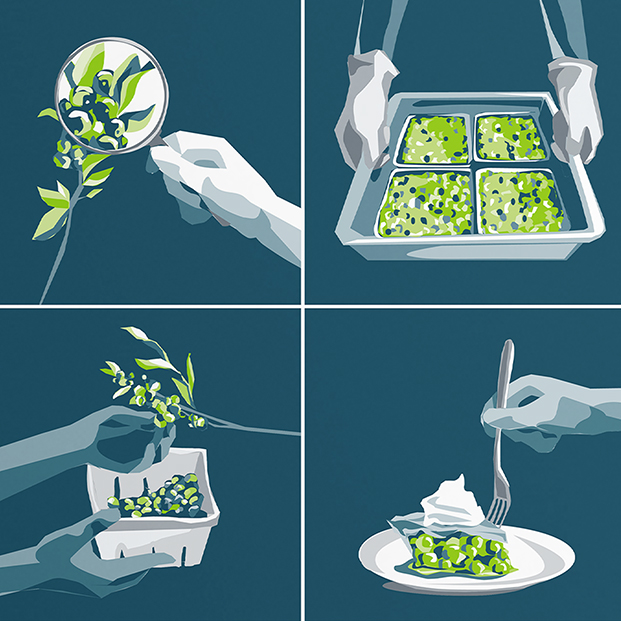

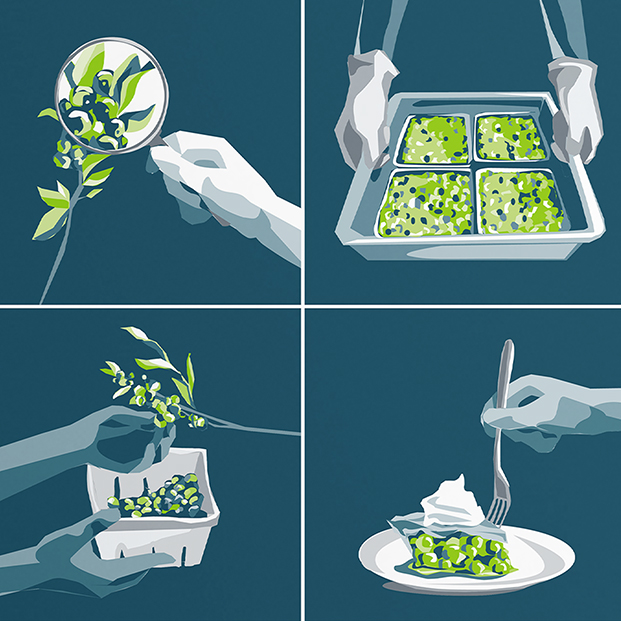

Building a Better Food System

Creating sustainable value, driving systemic change, and building a better food system for all.

Everything that's healthy

and better for you

Organic, natural, conventional &

specialty products

Everything that's healthy

and better for you

Organic, natural, conventional &

specialty products

Over 5,000 products

across 200 categories

Retail never stops moving.

Neither do we.

From Category Management to eCommerce,

we're here to help you keep up.

Your customers want the freshest, safest food.

That's where we come in.

We have the right technology and monitoring.

Giving you longer shelf life. High quality.

Happy customers.

1000

Your customers want the freshest, safest food.

That's where we come in.

We have the right technology and monitoring.

Giving you longer shelf life. High quality.

Happy customers.